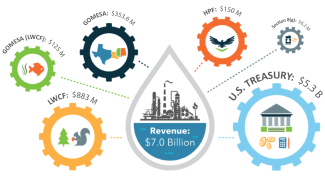

Resources on the Outer Continental Shelf (OCS) in U.S. waters belong to all U.S. citizens. OCS renewable energy development and oil and gas activities generate substantial revenues from lease sales, rental fees, royalties on OCS oil and gas production, and operating fees on OCS wind leases’ electricity generation. These funds are distributed to the U.S. Treasury and several different programs through various revenue sharing laws. The largest portion goes to the General Fund of the U.S. Treasury, which benefits all U.S. citizens through funding of daily operations of the Federal Government. A still-significant portion goes to states and special programs outlined below.

Information on revenues generated from OCS activities are provided by the Office of Natural Resources Revenue at the Natural Resources Revenue Data website. Two revenue sharing programs exist to share OCS oil and gas revenues with nearby states.

These include:

- Gulf of Mexico Energy Security Act (GOMESA) Enacted in 2006, GOMESA provides for revenue sharing in the Gulf of America (GOA) between the U.S. Treasury and the four Gulf oil and gas producing States of Alabama, Louisiana, Mississippi, and Texas.

- Section 8(g): 27% of revenue from leases in the 8(g) Zone (the first three nautical miles of the Outer Continental Shelf) are shared with states. See 43 U.S.C. § 1337(g). While similar revenue sharing is also available for renewable energy leases in the first 3 miles of federal waters, there are currently no leases in this area.

In addition, revenues collected from the OCS are distributed into two different funds to protect America’s historical places and recreation opportunities:

- Historic Preservation Fund (HPF)The National Historic Preservation Act of 1966 created the Historic Preservation Fund. The National Park Service administers the HPF.

- Land and Water Conservation Fund (LWCF) Congress established the LWCF in 1964 to safeguard natural areas, water resources and cultural heritage, and to provide recreation opportunities to all Americans. The 2020 Great American Outdoors Actprovides permanent funding for the LWCF using revenues from offshore oil and gas development to invest in recreation and conservation throughout the nation.

FY24 OCS REVENUE

Offshore Oil and Gas Revenue

$7.0 Billion

Offshore Wind Revenue

$15.9 Million

OCS Oil & Natural Gas Revenue and Disbursements FY 2024

Notes: Figures may not balance as revenue and disbursements contain adjustments for the prior fiscal year.

Units: 'M' = Millions; 'B' = Billions